Our Approach

We founded our Firm on the belief that incorporating proven allocation methodologies with lessons learned from behavioral science can lead to better outcomes.

- Our differentiated approach is built on our three-layered risk management process designed as a core implementable solution to a sound financial plan.

- Our Strategies are designed to provide competitive market performance that you can live with. Our risk first approach focuses us on the fact that we manage money for real people in real time, investing our own money alongside yours.

- Navigating volatile markets, a multitude of interest rate environments, and various economic cycles while having a plan in case of an emergency is the approach we believe can help investors do better.

Why Invest With Us

01

Our core Strategies provide a suite of easily understandable solutions for complex financial needs. Investors can see where they fall in the spectrum of available options and pinpoint the Strategy that fits their plan’s objectives.

02

03

Our Cash Indicator is an important component of our Strategies. It is a process designed to increase cash reserves to potentially protect their principal during extreme market downturns and reinvest at lower valuations as markets recover.

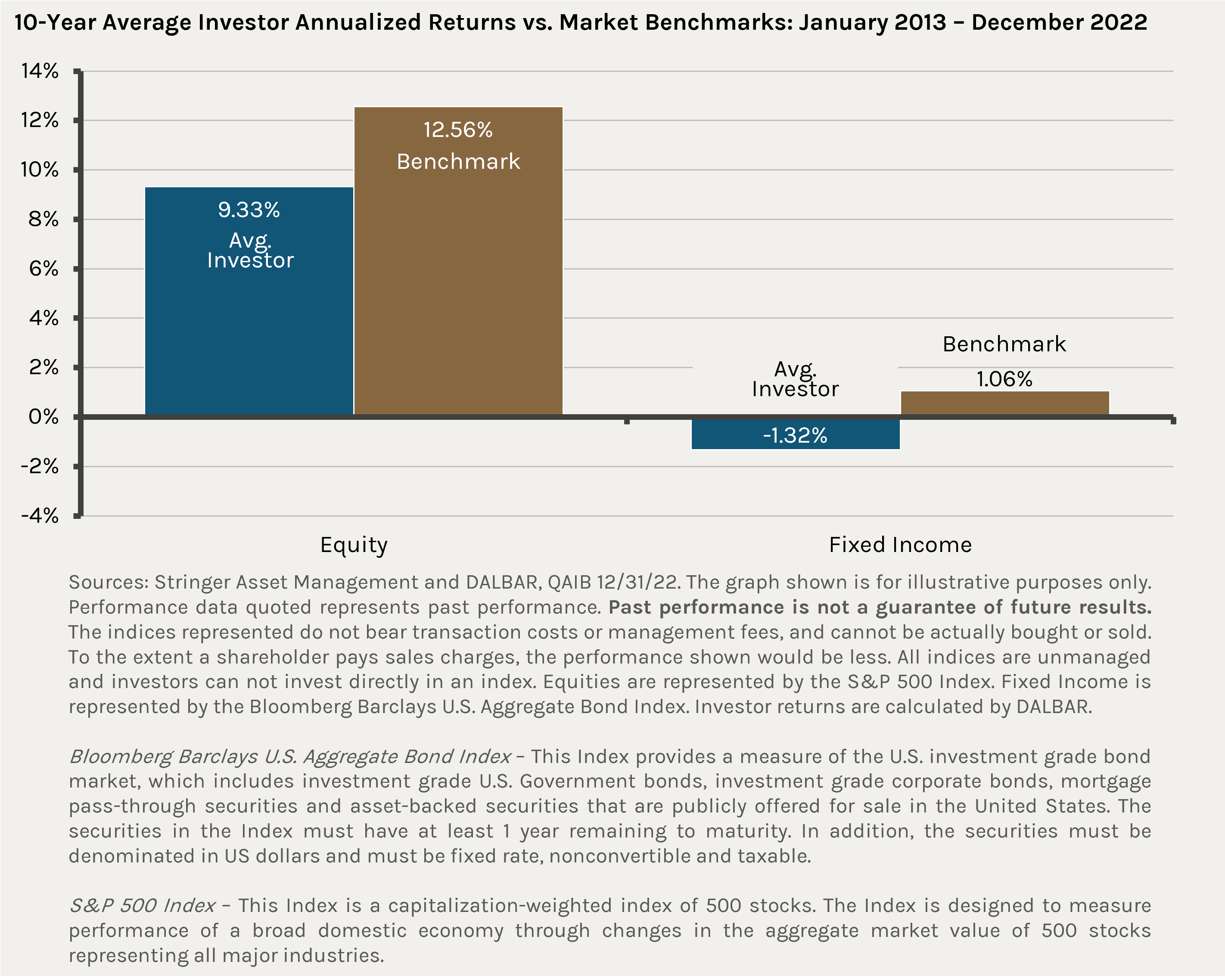

Investors tend to fall short of achieving the opportunities and returns presented by the financial markets. The impact of investment errors caused by the constant market noise, media-hype, and uncertainty of real world economic and market events may not be realized for years. We have dedicated our careers to refining our investment processes to avoid those emotional pitfalls and help you realize your financial goals.