Strategic Asset Allocation

(~75%)

While this traditional asset allocation forms the foundation of our risk-managed strategies, it is just the starting point for us. Over many years we have developed and refined an investment philosophy that takes into consideration a nearer-term outlook and incorporates subsequent breakthroughs in both behavioral finance and risk management.

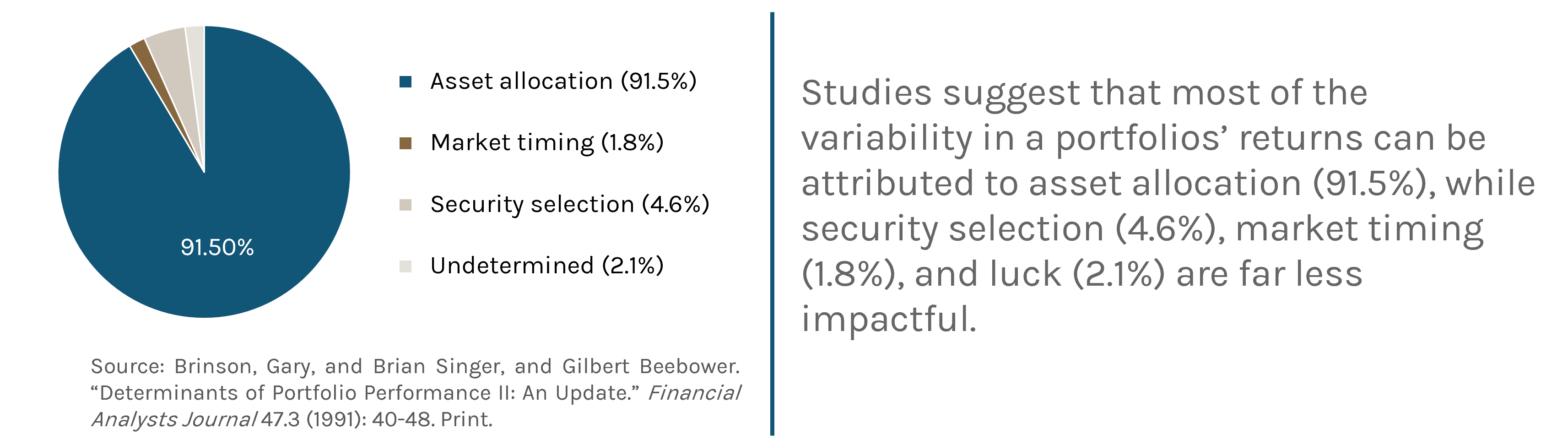

Traditional Asset Allocation Is Where We Start

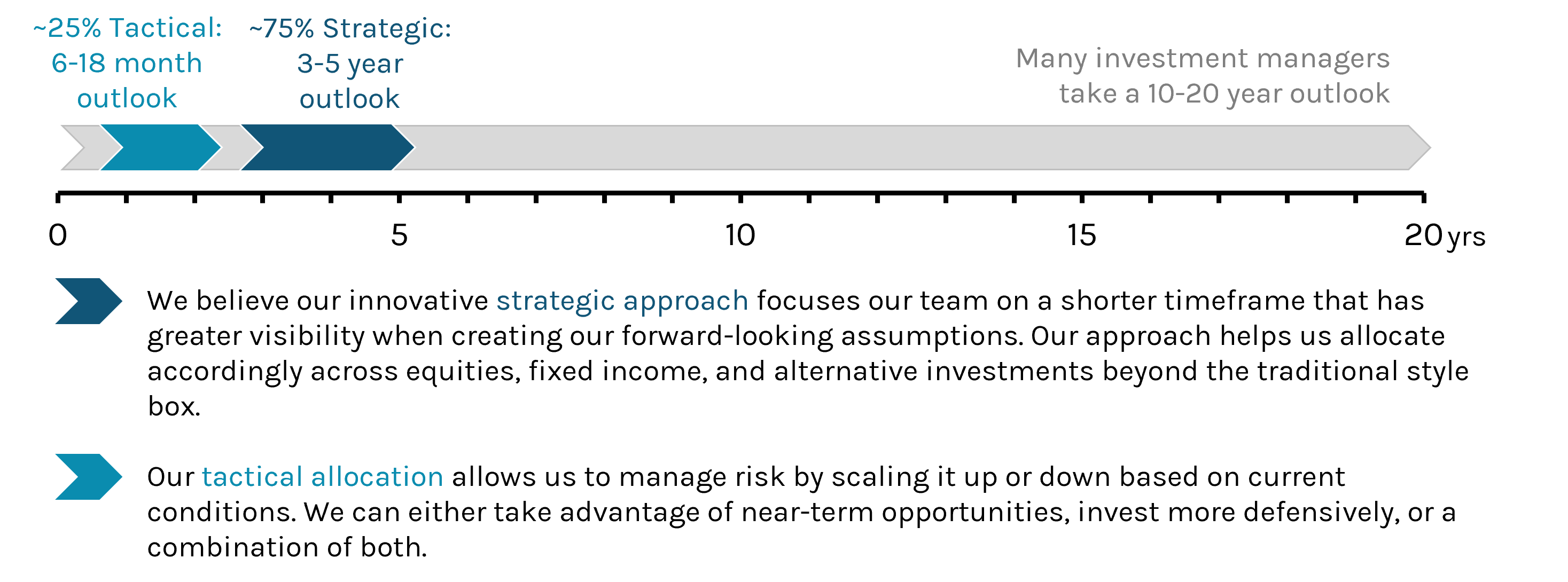

Our Innovative Approach: Our Strategic - Tactical Combination

There are several challenges to the basic assumptions of traditional asset allocation modeling that we address as part of our process. To address these inherent shortcomings, we focus on a ~75%/25% combination for our 3- to 5- year strategic outlook and our 6- to 18-month tactical outlook.

Our Strategic Difference

Our strategic process is designed to overcome behavioral biases while dynamically managing allocations to reflect our outlook.

- We create capital market expectations (CME) based on a 3-to-5-year outlook to ensure that we are not simply projecting forward a static model of the prior 10 -20 years.

- We utilize Multiple Scenario Analysis (MSA) to craft bull, bear, and base case scenarios. We then assign probabilities to those outcomes, which we monitor and adjust in real time. We believe this helps us remove some of the behavioral biases and clears the way for a more objective and flexible process for managing risk in real time.

- Our experienced team manages allocations dynamically by over or underweighting styles, regions, and asset classes as well as fixed income credit quality, duration, and type.

We designed this approach to provide more consistent risk-adjusted returns and give us more flexibility to manage risk in real time. This approach helps us allocate beyond the traditional style box.